tesla tax credit 2021 colorado

Are Dental Implants Tax Deductible In Ireland. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle.

Tax Credits Drive Electric Northern Colorado

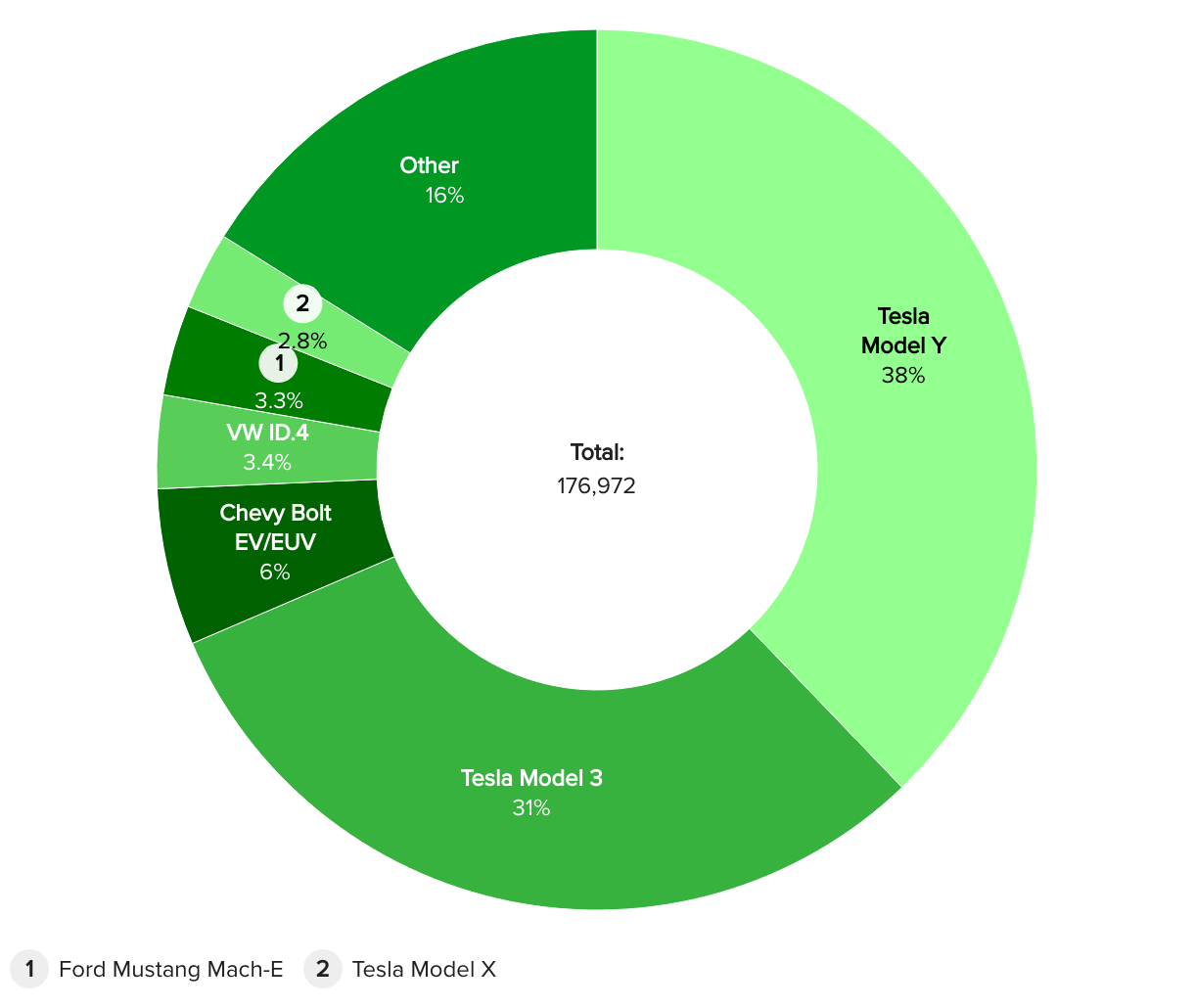

Sales of 2022 of Electric Vehicles continues go grow.

. Under most emission and rebate rules plug-in hybrids that combine a gasoline engine with a. Contact the Colorado Department of Revenue at 3032387378. Holy Cross has a per-kilowatt kW rebate for its customers to reduce the cost of going solar.

The credits which began phasing out in January will expire by Jan. Medium duty electric trucks have a GVWR of 10000 pounds to 26000 pounds. Opry Mills Breakfast Restaurants.

Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more electric cars in the US with new proposed reform of the federal EV incentive program. The credit is refundable. Posted on May 4 2021.

Right now you can get a 4000 tax credit in Colorado for the purchase or lease of ANY new all-electric vehicle and qualifying plug-in hybrid electric vehicles. State Local and Utility Incentives. Majestic Life Church Service Times.

The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall. At first glance this credit may sound like a simple flat rate but that is. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019.

Chevy Bolt Chevy Bolt EUV Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche. The table below outlines the tax credits for qualifying vehicles. Majestic Life Church Service Times.

Xcels new vehicle lease or purchase rebates are richer than Colorados state new EV tax credit which in 2021 fell to 2500 per vehicle Sobczak noted. March 14 2022 528 AM. By Joey Klender.

112020 112021 112023 112026 Electric or plug-in hybrid electric light duty passenger vehicle 5000 4000 2500 2000. If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69. Rebates of anywhere from 400 to 2500 depending on where you live are available for solar installations on homes in Pitkin and Eagle counties Eagle Valley the Town of Vail and Summit County.

The incentive amount is equivalent to a percentage of the eligible costs. To qualify for the Federal Tax Credit in a particular year the eligible solar equipment must be. 1 Best answer.

EV federal tax credit The. The dates above reflect the extension. President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying vehicles however this bill has only passed and not the Senate as of April 2022.

The 2021 RAV4 Prime plug-in hybrid still has the full 7500 tax credit. Tesla Model 3 vs. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

The rate is currently set at 26 in 2022 and 22 in 2023. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. This includes all Tesla models and Bolts that do not receive the Federal tax incentive.

You could also be eligible for a tax credit of 5000 for buying or converting a vehicle to electric or 2500 for leasing a light-duty EV or PHEV. 1 2021 to Jan. A few 2021 Mercedes Benz models like the X5 xDrive45e 330e and the 330e xDrive qualify for the credit.

In 2021 United States electric vehicle sales grew to over 430000 increasing from 2020. Since you asked about CO state tax the result was an entry of 5000 on line 22 of the 2017 form DR 0104 and the system added a Colorado 2017 form DR 0617 with the data listed above plus a check box for Purchased New and the 5000 amount on line 9 based on the size of the battery I think. Restaurants In Erie County Lawsuit.

Any vehicles purchased after that date are no longer eligible for the Federal credit due to the number of vehicles manufactured. For each weight classification and tax year the credit amount allowed for the lease of a qualifying vehicle is one half of the credit amount listed in the above table except that for tax years beginning on or after January 1 2021 and prior to January 1 2022 the credit for the lease of a qualifying light duty passenger vehicle is 1500. Many leased EVs also qualify for a credit of 2000 this year and then 1500 for leases made between Jan.

Tesla buyers in California can once again receive the States 1500 Clean Fuel Reward for purchasing an electric vehicle. The Consolidated Appropriations Act of 2021 signed December 27 2020 provided a two-year extension of the Investment Tax Credit for solar. Colorado also has various incentives for select solar utilities.

Registered in Colorado to qualify for the credit. Light duty electric trucks have a gross vehicle weight rating GVWR of less than 10000 lbs. The 2019 and 2021 Audi e-Tron also qualifies.

Tax credits are as follows for vehicles purchased between 2021 and 2026. Colorado EV Incentives for Leases. Restaurants In Erie County Lawsuit.

This is 26 off the entire cost of the system including equipment labor and permitting. So based on the date of your purchase TurboTax is correct stating that the credit is not. Credit amounts are higher for electric trucks and heavy.

Which Is More Reliable. I believe all Tesla models qualify for the full. Depending on your location state and local utility incentives may be available for electric vehicles and solar systems.

Opry Mills Breakfast Restaurants. Examples of electric vehicles include. Restaurants In Matthews Nc That Deliver.

Restaurants In Matthews Nc That Deliver. Tesla Tax Credit 2021 Colorado. To the extent that the amount of the credit exceeds tax the excess credit is refunded to the taxpayer.

Tesla Tax Credit 2021 North Carolina. Colorado offers a tax credit of up to 4000 for purchasing a new EV and 2000 for leasing one. So weve got 5500 off a new EV purchase or lease and 3000 off of used.

The 2021 Volkswagen ID4 First Pro and Pro S versions qualify. The tax credit for most innovative fuel vehicles is set to expire on January 1 2022. New EV and PHEV buyers can claim a 5000 credit on their income tax return.

Are Dental Implants Tax Deductible In Ireland. This tax credit goes down to 2500 on January 1 2021 so buy your car now to take advantage of. If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system.

Latest On Tesla Ev Tax Credit March 2022

Zero Emission Vehicle Tax Credits Colorado Energy Office

Tax Credits Drive Electric Northern Colorado

Colorado Solar Incentives Colorado Solar Rebates Tax Credits

Pros And Cons Of Buying An Electric Vehicle In 2020 Vs 2021 Aspentimes Com

Colorado Ev Incentives Ev Connect

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Considering An Electric Car The Build Back Better Bill Could Save You Thousands Cbs News

Colorado Approves Nearly 20 Million In Incentives In Return For 1 020 Potential New Jobs

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

Tax Credits Drive Electric Colorado

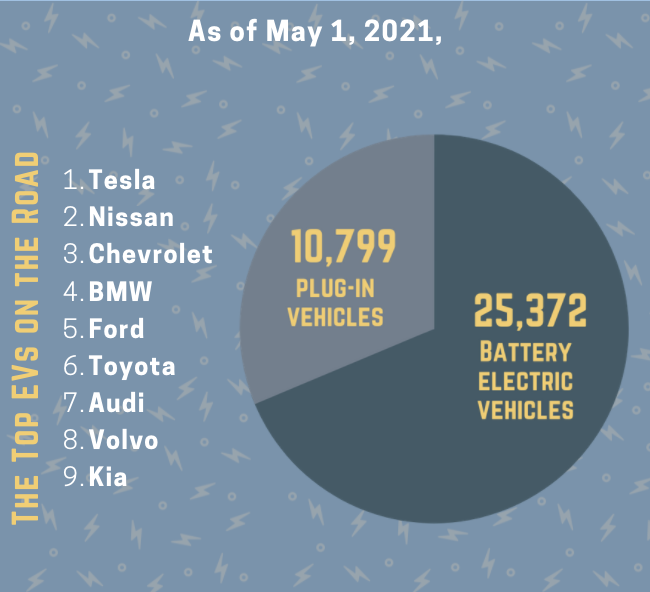

Electric Vehicles In Colorado Report May 2021

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

How Do Electric Car Tax Credits Work Credit Karma

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Tax Credits Drive Electric Colorado